Dominion Lending Centres

Enter a key term, phrase, name or location to get a selection of only relevant news from all RSS channels.

Enter a domain's or RSS channel's URL to read their news in a convenient way and get a complete analytics on this RSS feed.

Unfortunately Dominion Lending Centres has no news yet.

But you may check out related channels listed below.

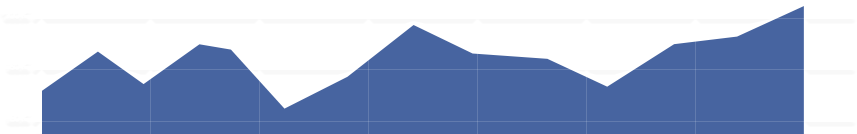

[...] Home prices up 0.4% in JanuaryCanadian home prices in January were up 0.4% from the previous month, according to the Teranet-National Bank National Composite House Price Index™. It was the [...]

[...] Canadian home prices in March were up 0.6% from the previous month, according to the Teranet-National Bank National Composite House Price Index™. It was the [...]

[...] Canadian home prices in April were up 1.1% from the previous month, according to the Teranet-National Bank National Composite House Price Index™. That rise took [...]

[...] annual inflation rate fell slightly in February, giving the Bank of Canada room to keep interest rates low over the next few months, economists say.Statistics Canada said Friday its consumer [...]

[...] Interest rates in Canada are controlled by the monetary policy interest rate decisions of the Bank of Canada [...]

[...] , April 12, 2011 — One-third (33 per cent) of B.C. residents say that rising food and gas prices have had a significant impact on their budget,... [...]

[...] , April 12, 2011 — One-third (33 per cent) of B.C. residents say that rising food and gas prices have had a significant impact on their... [...]

[...] Most buyer's main concern is the commute to work.Rising gas prices have spurred homebuyers to look for homes that offer shorter commute times to work, according [...]

[...] Ever wonder what the difference is between a mortgage broker and the representative is at your bank? When dealing with a bank, you deal with only that [...]

[...] always thought getting a mortgage would be a challenge. But within 18 days of visiting a mortgage broker, they were able to close a deal on a new townhouse in Calgary without a hitch.Now in their [...]

[...] Canadian home prices in April were up 1.1% from the previous month, according to the Teranet-National Bank [...]

[...] Canadian home prices in March were up 0.6% from the previous month, according to the Teranet-National Bank [...]

[...] — One-third (33 per cent) of B.C. residents say that rising food and gas prices have had a significant impact on their budget,... [...]

[...] — One-third (33 per cent) of B.C. residents say that rising food and gas prices have had a significant impact on their... [...]

[...] Bank of Canada maintains overnight rate target at 1 per centOTTAWA –The Bank of Canada today announced that it is maintaining its [...]

[...] The Bank of Canada held their scheduled meeting today and as expected they kept the overnight rate the same at 1.00%. This rate has remained at 1.00% since September 2010, the longest time in [...]

[...] HIGHER COSTS FOR GAS, FOOD IMPACTING B.C. BUDGETS:RBC CANADIAN CONSUMER OUTLOOK INDEXTORONTO, April 12, 2011 — One-third (33 per [...]

[...] HIGHER COSTS FOR GAS, FOOD IMPACTING B.C. BUDGETS:RBC CANADIAN CONSUMER OUTLOOK INDEXTORONTO, April 12, 2011 — One-third (33 per [...]

[...] Home prices up 0.4% in JanuaryCanadian home prices in January were up 0.4% from the previous month, according to the Teranet-National Bank National Composite House Price Index™. It was the [...]

[...] Canadian home prices in March were up 0.6% from the previous month, according to the Teranet-National Bank National Composite House Price Index™. It was the [...]

[...] Canadian home prices in April were up 1.1% from the previous month, according to the Teranet-National Bank National Composite House Price Index™. That rise took [...]

Related channels

-

Mortgage Lending Direct - Your Mortgage Advisors with Biblical Values

Combining Christian values, leading-edge technology, a “common sense” lending approach and some of the lowest rates in t...

-

Credit And Lending

Get Detailed Information About The Credit And Lending

-

AZ Lending Experts

The premiere source for your Arizona mortgage lending needs